Guide to Legal Insurance for Indians in Germany

Discover the essential details of legal insurance in Germany and why it is crucial for expatriates, especially those from India, to secure comprehensive legal protection.

Understanding Legal Insurance in Germany

Legal insurance in Germany serves as a crucial safety net, providing coverage for various legal disputes. However, it typically comes with a waiting period before you can make a claim. This waiting period is designed to prevent individuals from taking out insurance only when they foresee imminent legal issues. It ensures the sustainability of the insurance model, allowing insurers to offer comprehensive coverage without facing disproportionate risks.

Types of Legal Insurance and Their Waiting Periods

In Germany, legal insurance can be categorized into several types, such as car legal protection, private legal protection, employment legal protection, and property legal protection. Car legal protection usually allows for immediate coverage, making it an exception in the realm of legal insurance. However, for other types of legal insurance, a waiting period of 3-6 months is typically required before claims can be made.

This waiting period is crucial for insurers to manage risk and provide sustainable coverage. It ensures that policyholders do not purchase insurance only when they anticipate a legal dispute, which could otherwise lead to financial strain on the insurance system.

Special Considerations for Expats from India

Expats from India often face unique challenges when relocating to Germany. These challenges can include navigating new employment contracts, understanding tenant rights in the housing market, and dealing with property purchases or rentals. As many Indian expats occupy higher positions in their respective fields, the need for robust legal protection becomes even more critical.

Given the complexities of the German legal system and the potential for disputes in employment and property matters, having legal insurance with a shorter waiting period can be invaluable. This is especially true for expats who may not be fully acquainted with the local legal landscape.

Why NRV Insurance Stands Out

NRV insurance is particularly noteworthy for its shorter waiting period of just two months, compared to the usual 3-6 months. This makes it an attractive option for those who need quicker access to legal protection. Additionally, NRV offers a comprehensive performance package that is well-suited for expats from India.

With NRV, policyholders can benefit from a broad range of legal coverage, including private, employment, and property legal protection. For Indian expats who are often involved in property transactions and high-level employment roles, NRV's offerings provide a robust and timely safety net.

Navigating the German Legal Landscape

The German legal system can be intricate and challenging to navigate, especially for newcomers. Legal insurance can provide the necessary support by covering legal fees, offering advice, and representing policyholders in disputes. This is particularly beneficial for expats who may not be familiar with local laws and regulations.

Having a reliable legal insurance provider like NRV can make a significant difference, offering peace of mind and ensuring that any legal issues are managed effectively and efficiently.

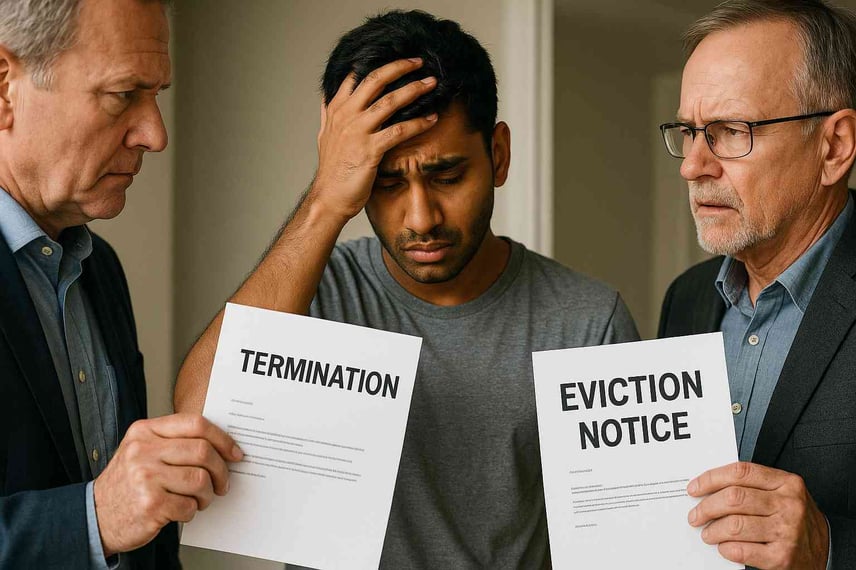

More legal cases in the Job market and Real Estate

The current job and housing markets in Germany are highly competitive, leading to an increase in legal disputes. Employment-related issues such as contract disputes, wrongful termination, and workplace discrimination are not uncommon. Similarly, the real estate market can present challenges related to property purchases, tenant rights, and rental agreements.

For Indian expats, who are often involved in property transactions and high-level employment roles, having legal insurance with a shorter waiting period is particularly advantageous. It ensures that they are protected and can address any legal issues that arise promptly and effectively.